Reclaim Your Freedom. Take Control of the Chaos.

Thrive in the Sandwich Generation:

3 Easy Steps to Reclaim Your Time and Freedom

In just one afternoon, this empowering online course shows you how to take control, avoid overwhelm, and reclaim the time, freedom, and peace you’ve been missing.

- 3 Easy Video Modules

- Detailed Lecture Notes

- Exclusive Content

- Lifetime Access

When Their Finances Start to Take Over Your Life...

You’re focused on your own goals, your family, your future.

Then suddenly, you’re the one figuring out your parents’ finances—and everything feels like it’s slipping away.

From managing medical bills to navigating insurance and estate decisions, it’s exhausting and disruptive.

You didn’t plan for this, and you’re not trying to become a caregiver. You just want to protect your life from getting swallowed up by someone else’s responsibilities.

- Fast, Affordable & 100% Self-Paced Online Program

3 Easy Steps to Reclaim Your Time, Your Happiness, and Your Life

This course gives you more than strategies—it gives you back your freedom.

In just 3 simple modules, you’ll get the clarity, knowledge, and confidence to manage your parents’ finances without losing yourself in the process.

In just 3 short modules, you’ll learn how to:

Plan for Their Needs Without Sacrificing Yours

Know Exactly What They Have—And What It Means for You

Feel Confident, Not Confused

Whether you’re just stepping into this role or already overwhelmed, these simple steps give you a clear path forward—without the burnout.

- Fast, Affordable & 100% Self-Paced Online Program

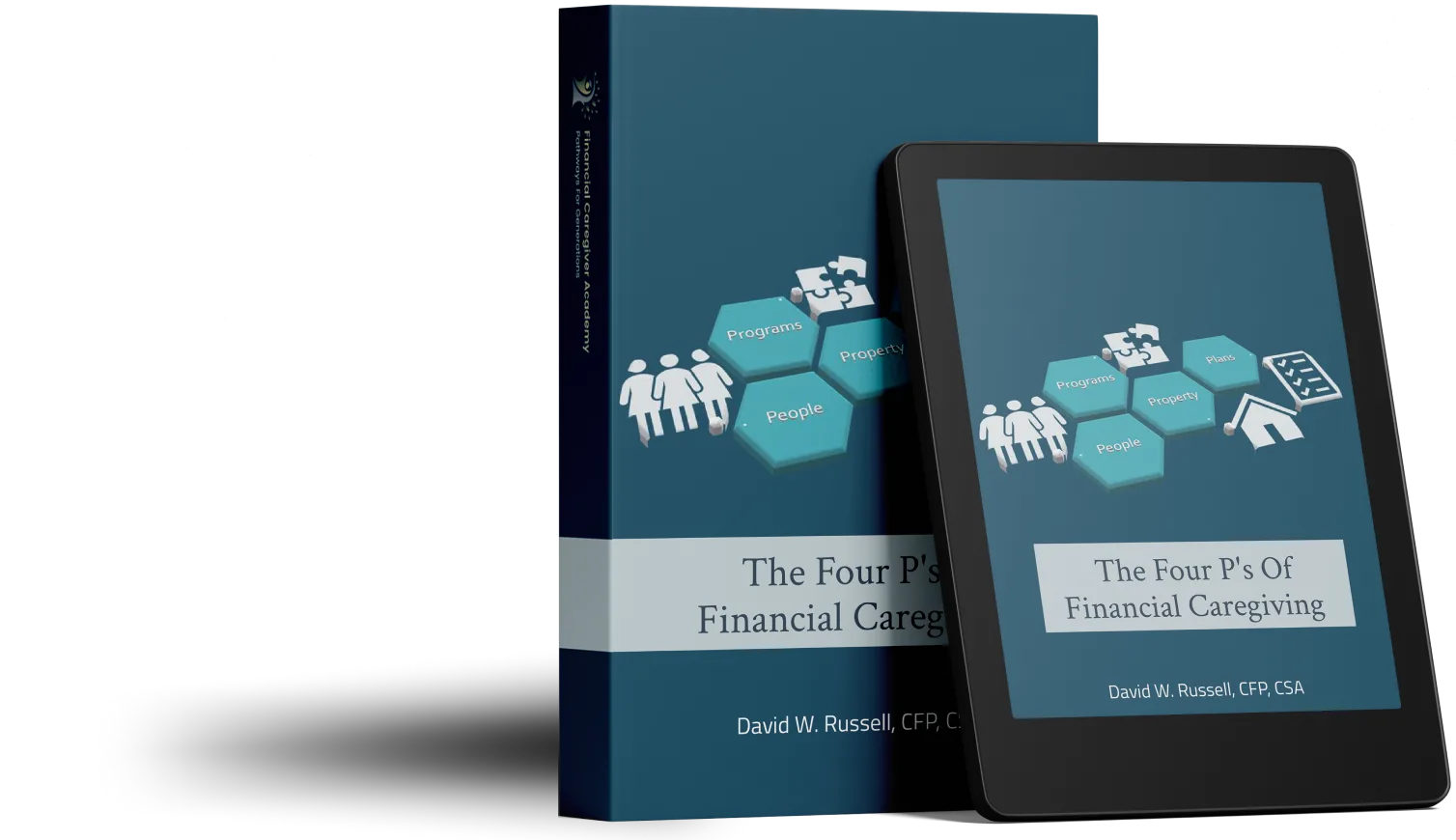

Get the Course Companion eBook For Free - "The Four P's Of Financial Caregiving"

Once you’ve made the decision to get more involved, several questions must be answered:

- What needs to be done?

- Who will be in charge?

- What do I need to know?

The key areas that you as the adult child will need to be involved in are what are known as the – Four P’s: People, Property, Programs, and Plans.

How This Course Has Transformed the Journey for Financial Caregivers Like You

Here’s how Financial Caregiver Academy has helped hundreds of families navigate the financial challenges of caregiving.

"It brought us closer together"

Sarah

Second child in the Baker Family Case Study

"A transformative experience"

Michael

Third child in the Baker Family Case Study

"It changed how I approach caregiving"

Vanessa

Daughter in the Stan and Marjorie Case Study

"I now feel confident and empowered"

Mark

Son in the Stan and Marjorie Case Study

Freedom Starts With Clarity

This course isn’t about becoming a financial expert. It’s about learning just enough to keep your life on track—even when unexpected responsibilities land on your plate.

Get Essential Tools for Caregiving

Plan for Their Needs Without Sacrificing Yours

Learn how to prepare for estate planning, Medicare choices, and long-term care without it taking over your time or energy.

- Estate Planning

- Medicare Supplement

- Long-term Care

Get Essential Tools for Caregiving

Know Exactly What They Have—And What It Means for You

You’ll learn how to organize assets and investments quickly, so you’re not left in the dark when decisions need to be made.

- Organize Their Assets & Finances

- Organize Their Investments

Get Essential Tools for Caregiving

Feel Confident, Not Confused

Skip the overwhelm. We break it down so you know what matters, what doesn’t, and who to call when you need help.

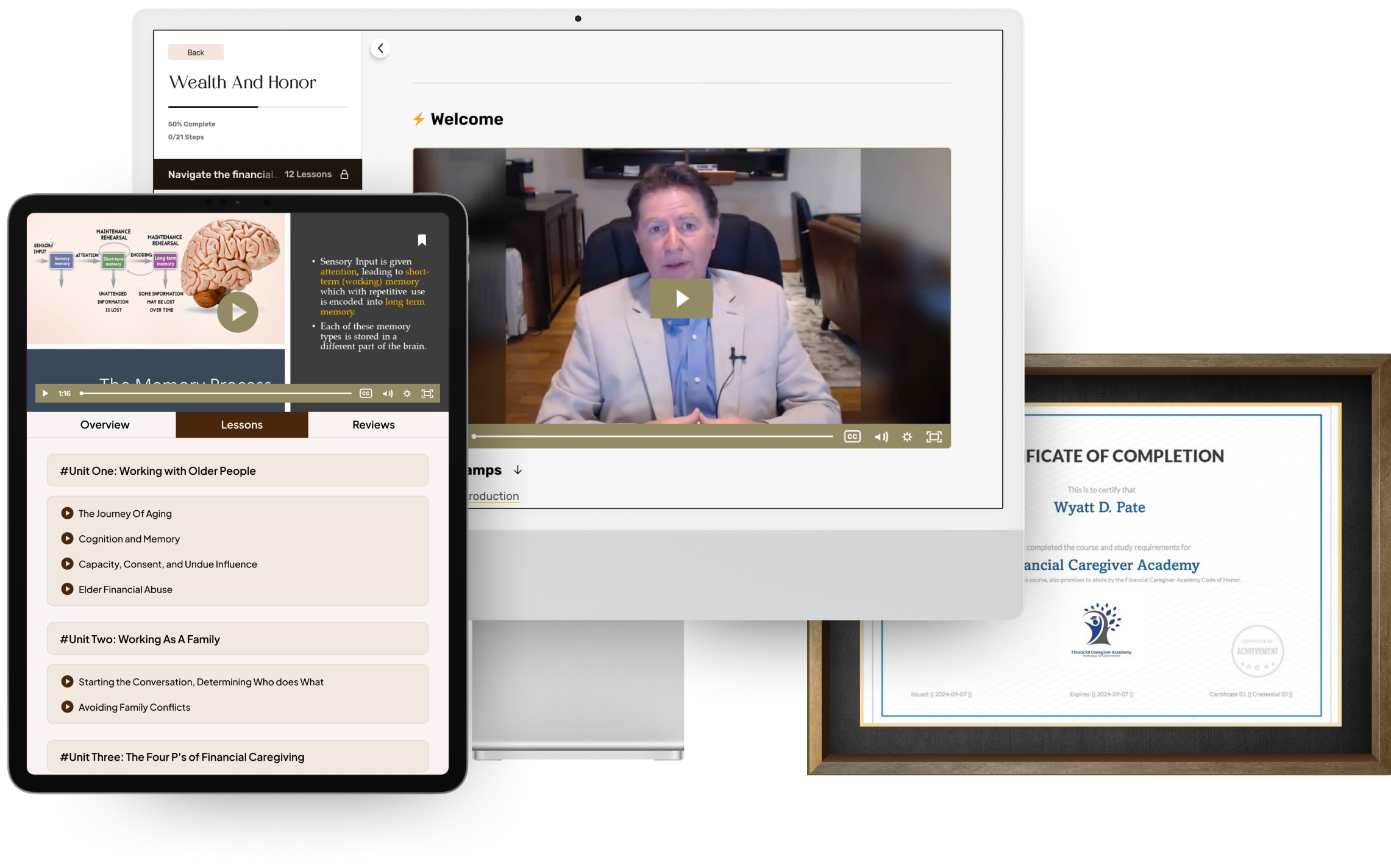

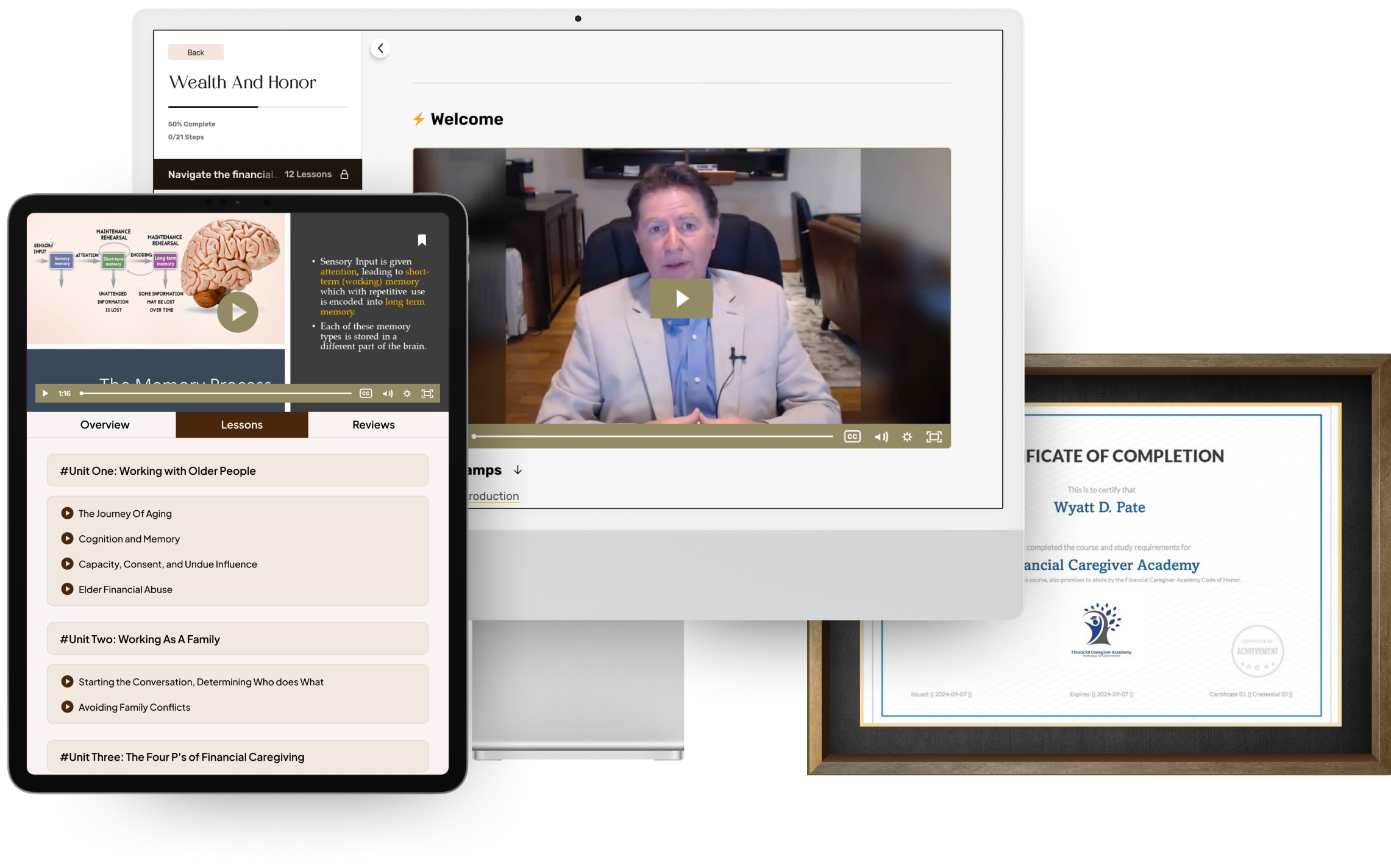

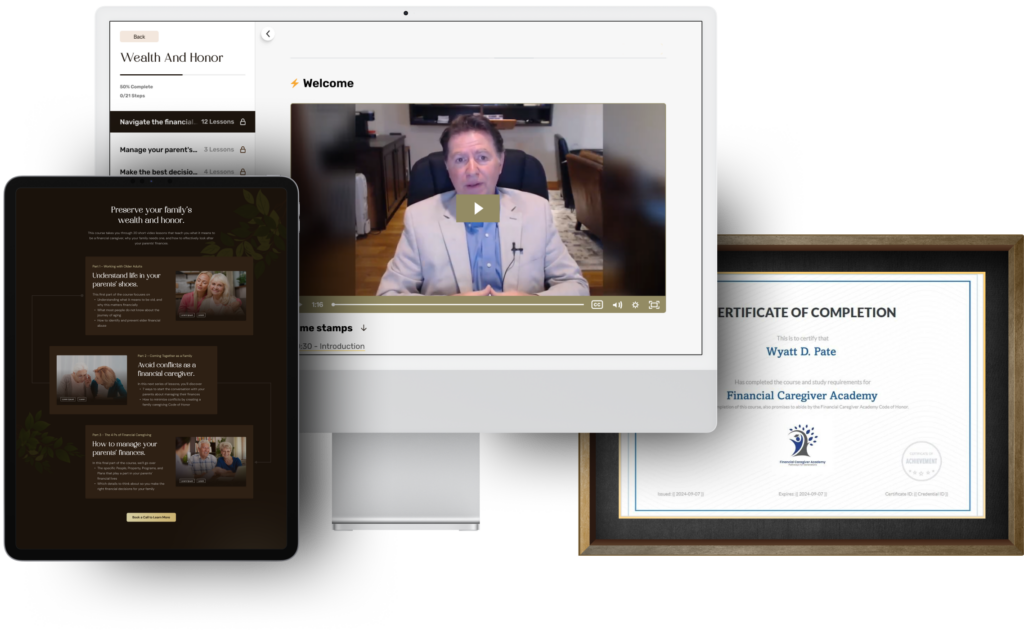

Learn from anywhere

Easy online access lets you complete your courses on any smart device at your own pace.

Certificate of completion

Showcase your knowledge with a Financial Caregiver Certificate.

Taught by experts

Throughout his 30+ year career, David W. Russel, CFP®, CSA® has helped hundreds of families plan for their future,

5 Free Financial Caregiving eBook Series

Get the Bonus eBook – “The Four P’s Of Financial Caregiving” for Free.

Financial Caregiving Made Simple

- Online training at your own pace and in your own time

- Compatible with computers, tablets, or mobile devices

- Lifetime Community Forum & Support

What's inside the course?

I launched Financial Caregiver Academy with a mission to provide others with the guidance and knowledge to:

- Honor our aging family members

-

Foster stronger communication and

relationships within the family - Understand the aging process better

- Create a financial plan for age transitions

SAVE 40% TODAY

Financial Caregiving Made Simple Online Course & Membership

One Time

$195.00

$325.00

Or

$27/mo.

$45/mo.

Join the Financial Caregiver Academy today and find all the support and knowledge you need to lift away the stress of looking after a loved one’s finances.

Get Instant Access to:

- 3 Financial Caregiver Academy Video Modules

- 5 FREE Bonus E-Books Included

- Monthly Live Q&A Webinars

- Weekly Exclusive Content

- Community Forum & Support

- Personalized Certificate of Completion

- 30-Day Money-Back Guarantee

FREE BONUS MATERIAL INCLUDED

Working as a Family Guide

Discover how family dynamics impact caregiving roles. I’ll share practical tips to minimize conflict and foster family unity while preserving your aging parents’ dignity.

Plans for Long Term Care Guide

A guide to help you navigate long-term care planning, covering housing options, costs, payment strategies, and a helpful questionnaire for personalized planning.

Guide to Medicare

What you need to know about Medicare options, what each part covers, and doesn’t cover, Medicare Advantage, and Medicare Prescription (Part D Plans) in plain English. Learn how to avoid penalties and maximize your benefits.

Social Security Benefits Guide

A comprehensive guide to Social Security benefits, detailing types, eligibility, taxation, and more to help you make informed decisions about your financial future.

Essential Estate Planning

Master the essentials of estate planning with my comprehensive guide, covering Wills, Power of Attorney, and Healthcare directives, plus a checklist to prepare for your attorney meeting.

The Four P's Of Financial Caregiving

The key areas that you as the adult child will need to be involved in are what are known as the – Four P’s: People, Property, Programs, and Plans.

SPRING SALE GET 40% TODAY

Financial Caregiving Made Simple Full Course (Complete Version)

- Bonus 5x E-Books Included

- Personalized Certificate of Completion

$149.00

$349.00

Get Instant Access to:

- 20 Video Lessons (5 hrs)

- Downloadable Course Lessons

- Bonus 5x E-Books Included

- Community Forum & Support

- Self-Paced Learning

- Personalized Certificate of Completion

- 30-Day Money-Back Guarantee

Financial Caregiving Made Simple Crash Course (Short Version)

$47.00

$149.00

Get Instant Access to:

- 4 Video Lessons (40 min)

- Downloadable Course Lessons

- Self-Paced Learning

- 30-Day Money-Back Guarantee

A Few Steps Today for Effortless Financial Caregiving Tomorrow

You don’t have to be a professional financial advisor to be an effective financial caregiver. This program gives you the knowledge and resources to secure your parents’ financial future.

- Module 1

The Journey of Aging

Duration: 1 h (4 Video Lessons + Quizzes)

- Understanding the Aging Process

- Memory and Cognition

- Capacity, Consent, and Undue Influence

- Preventing Elder Financial Abuse

Learn a Compassionate Perspective of Age Transitions

Explore the aging process through a new and compassionate perspective. You will gain understanding of aging and how it affects people differently, as well as the difference between cognitive diseases and normal aging.

- Module 2

Working as a Family

Duration: 50 min (2 Video Lessons + Quizzes)

- How to Start The Conversation With Your Parents

- Defining Roles And Responsibilities

- How to Avoid Family Conflicts

- Creating a Family Code of Honor

How to Communicate Effectively and Avoid Conflict as a Financial Caregiver

You and your family will learn how to minimize caregiving conflict and place honoring your parents as a key priority. You’ll get tips on how to create effective communication among parents and siblings, and what the root causes of conflict are.

- Module 3

The Four P’s of Financial Caregiving

Duration: 2 h 10 min (14 Video Lessons + Quizzes + eBook)

- Organize and Create a Plan for the People, Property, and Programs that impact your parents

- Social Security, Medicare, and Medicaid

- Estate Planning, Power of Attorney, and Medical Directives

- Create a Plan for Advanced Age even if your parents are already there

- Help them make the Right Financial Decisions to protect them as they age

Gain Valuable Insight to Aid You in Your Journey as a Financial Caregiver

This in-depth module will train you on each of the aspects of financial caregiving. You will come away with a necessary understanding of the Four P’s of financial caregiving and what you will need to know about each of these to effectively manage your parent’s financial lives.

Our 30-Day Money-Back Guarantee

Course Curriculum

This course takes you through 20 video lessons that teach you what it means to be a financial caregiver, why your family needs one, and how to effectively look after your parents’ finances.

Module 1

Navigate the Financial Challenges of Age Transition

Video Content, Quiz & Feedback

Video Content, Quiz & Feedback

Video Content, Quiz & Feedback

Video Content, Quiz & Feedback

Module 2

How to Communicate Effectively and Avoid Conflict as a Financial Caregiver

Video Content, Quiz & Feedback

Video Content, Quiz & Feedback

Module 3

Making the Right Financial Choices for Your Family’s Future

Video Content, Quiz & Feedback

Video Content, Quiz & Feedback

Video Content, Quiz & Feedback

Video Content, Quiz & Feedback

Video Content, Quiz & Feedback

Video Content, Quiz & Feedback

Video Content, Quiz & Feedback

Video Content, Quiz & Feedback

Video Content, Quiz & Feedback

Bonus Material:

- The Companion eBook "The Four P's Of Financial Caregiving"

David W. Russell, CFP®, CSA®

Vice President & Wealth Advisor

Throughout his 30+ year career, David has helped hundreds of families plan for their future, focusing on estate plan design and trust management for high net worth families. As a Certified Financial Planner and Certified Senior Advisor, he is frequently asked to speak at events and translate complex issues into understandable language.

Having been the financial caregiver to his own parents, David authored his first book in 2012, What You Need to Know: The Adult Child’s Guide to Becoming an Effective Financial Caregiver. Since then, he’s focused his career on helping families face the financial issues of age transitions.

How hundreds of families have protected their legacy.

A surprise diagnosis reunites the Bakers.

Brother and sister honor Mom an Dad’s legacy.

Caring for her parents while raising two kids.

The skills you need to be an effective and compassionate Financial Caregiver

1

2

3

Step 1: It brought us closer together

- Schedule a consultation to discuss your unique situation

- Understand the course structure and how it can benefit you

- Get answers to any initial questions you may have

Step 2: Personalized Guidance That Fits into Your Life

- Receive tailored advice and a customized plan

- Learn about the proven strategies to manage your parents’ finances

- Develop a clear action plan that’ll allow you become your parents financial caregiver

Step 3: Implement Proven Strategies

- Access comprehensive resources and tools

- Start applying strategies to become your parents' financial caregiver

- Achieve balance by delivering the best care without sacrificing your own life

You don’t have to be a financial advisor to be an effective financial caregiver.

Join us at Financial Caregiver Academy and find all the support and knowledge you need to lift away the stress of looking after a loved one’s finances.

- Financial Caregiver Made Simple Course

- The Companion eBook "The Four P's Of Financial Caregiving"

- 5 Free Financial Caregiving eBook Series

- Course Lesson Quizzes

- Personalized Certificate of Completion

- Lifetime Community Forum & Support

- 30-Day Money-Back Guarantee

40% Discount For Limited Time

Lessons I wish I’d known before my Dad’s dementia.

When my family learned that my Dad had dementia, we knew we’d have to work together to provide the care he needed.

As his condition progressed, so did the emotional & physical demands, but…

Nothing prepared us for the stress and frustrations that came with financial caregiving.

From managing unexpected medical bills to sorting through insurance policies, the decision fatigue completely took over our lives.

That’s exactly why I launched Financial Caregiver Academy!

To help you avoid the consequences of financial caregiving, so that you can:

- Honor our aging family members

-

Foster stronger communication and

relationships within the family - Understand the aging process better

- Create a financial plan for age transitions

With the right combination of support and knowledge, you can help preserve your parents’ dignity and quality of life as a compassionate financial caregiver – WITHOUT sacrificing your personal life.

Lessons I wish I’d known before my Dad’s dementia.

"It brought us closer together"

It brought us closer together

Sarah

Second child in the Baker Family Case Study

A transformative experience

Michael

Third child in the Baker Family Case Study

Changed how I approach caregiving

Vanessa

Daughter in the Stan and Marjorie Case Study

I now feel confident and empowered

Mark

Son in the Stan and Marjorie Case Study